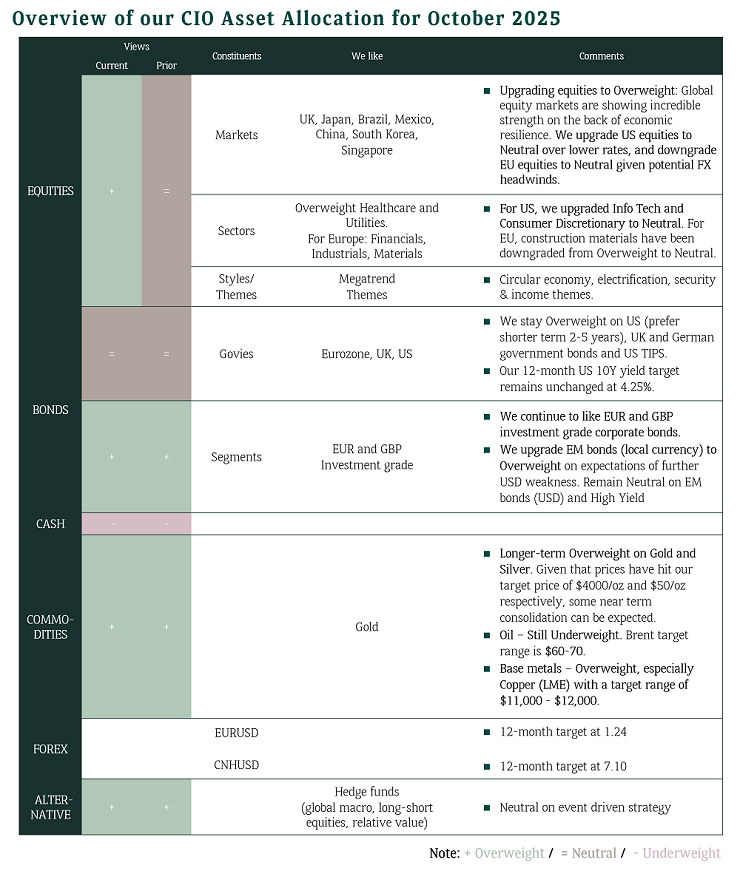

Investment Navigator, Asia Edition, October 2025

One of the most frequent questions we receive is:

“What is the probability of a year-end rally in global equities?”

This question resonates with investors as we approach the final stretch of the year, a period often characterised by heightened expectations and strategic decision-making. To answer this, we turn to the four key ingredients that typically set the stage for a rally.

Understanding how these elements interact, especially in the context of year-to-date market performance and broader macroeconomic dynamics, is critical for assessing the likelihood of a strong finish to the year. Let us take a closer look at what is driving the optimism – and the risks that could stand in the way.

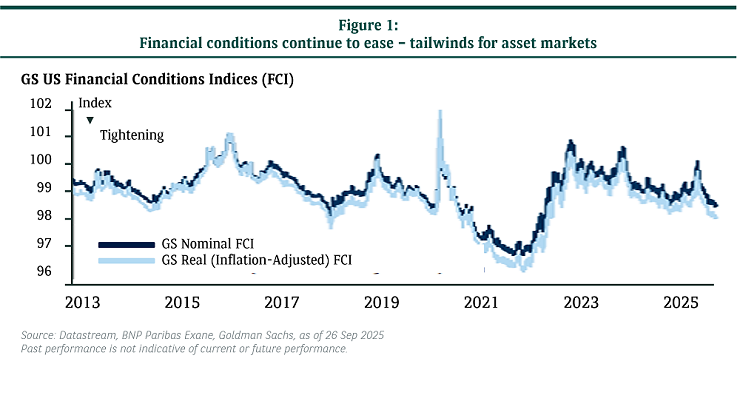

1. Easing Global Financial Conditions

2. Solid Corporate Earnings

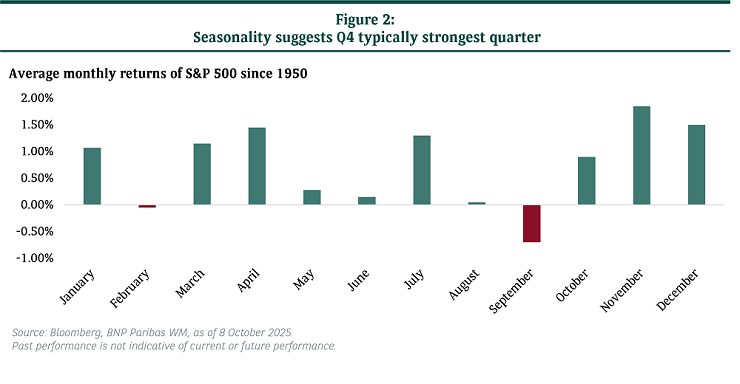

3. Favourable Seasonality

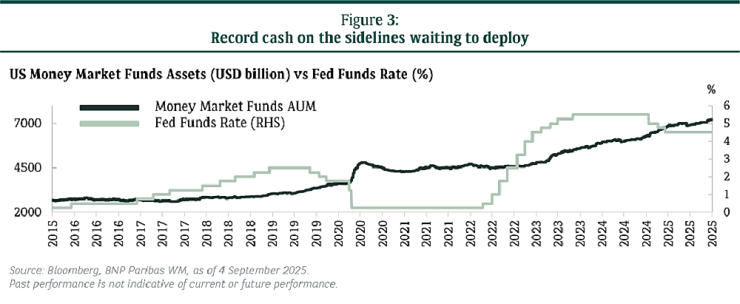

4. Investor Positioning

1. Easing Global Financial Conditions

The Federal Reserve’s Pivot as we wrote about in September’s Investment Navigator has finally begun. We currently expect two further rate cuts from the US Federal Reserve this year – one in October and another in December – followed by two more cuts in the first half of next year.

Meanwhile, although we do not anticipate further easing from the European Central Bank (ECB), it has implemented significant cuts, lowering rates by more than 200 bps since May 2024.

In contrast, China continues to grapple with a deflationary environment, not an inflationary, and is maintaining both monetary and fiscal easing measures.

Credit spreads are tight, and the US dollar has weakened. This combination boosts global liquidity and allows emerging market central banks to join in the rate-cutting cycle. The loosening of financial conditions is typically a leading indicator, though it tends to act with a lag. As a result, global equities could see a further boost in the fourth quarter, despite already strong performance year-to-date.

2. Earnings Matter

In the US, earnings exceeded expectations in the second quarter. In Europe, while earnings were more restrained – partly due to a stronger currency – consensus still points to double-digit earnings growth next year. Meanwhile, earnings revisions in China appear to be bottoming out, with forecasts calling for double-digit growth by 2026. In Japan, companies are quietly delivering record share buybacks, driven by strong earnings this year, which are forecasted to grow by 10%.

The key driver behind this global earnings growth trend is the absence of a major economic slowdown over the next 15 months. While we do not anticipate significant further multiple expansion – particularly in the US – equities can still appreciate, albeit likely at a more moderate pace if this trend continues.

3. Seasonality

Seasonal trends can impact markets as well. The S&P 500 generally shows robust Q4 seasonality with a win rate of 74% and average return of +4.2% since 1950 (see Figure 2). Similarly, Europe also has a 68% positive quarters and an average return of +2.8% since 1998. That said, these figures represent averages. For instance, in 2022, the S&P 500, Euro Stoxx 600, and Shanghai composite all declined during the fourth quarter. The key will be a continuation of a “Goldilocks” economic narrative: soft landing in GDP and a more gradual or controlled pickup in inflation.

4. Positioning

Even after the strongest equity rally since the pandemic, positioning is higher but still not extended yet. Global fund managers remain bullish on equities. Hedge funds are running sizeable gross portfolios (short plus longs), but their net exposure to the market remains moderate by historical standards.

Retail investors are currently the most bullish, with US retail investors leading the charge at near record high levels. However, sentiment indicators are not at alarming levels in terms of American Association of Individual Investors (AAII) surveys. Therefore, while a correction is both overdue and expected, current sentiment does not point to a macro market top.

Risks to the Rally?

- Any larger-than-expected drop in economic growth and unexpected pick up in inflation could lead to more than a small correction. Historically, stagflation has been the most unfavourable scenario for both stocks and bonds.

- A breakdown in the trade framework deals announced thus far, or a loss of momentum toward a US-China trade deal, could dampen business capital expenditures and investment activity.

- Any slowdown in AI-related capex, which has been revised upward throughout the year, would likely weigh on equities, particularly US equities. Given the market’s concentration in the technology sector, such a slowdown could also have ripple effects across Taiwan, China tech, and Korea.

- Any major escalation in geopolitical conflict could drive oil prices significantly higher, posing a potential headwind for a year-end rally.

Is the stage set for a year end rally?

- Global financial conditions continue to loosen, which is typically a strong tailwind for risk assets.

- Seasonality suggests a Santa Claus rally given Q4 is usually the strongest quarter of the year.

- Economic resilience and strong corporate earnings provide fundamental reasons to remain bullish.

- Investor positioning is likely to support risk assets, as the pace of rotation away from money market funds picks up, driven by the forecast of lower interest rates.

- We think that momentum is likely to stay, given the strong increase in risk appetite.

- With that, we are now Overweight on Global Equities. Region wise, we are Neutral on US and EU equities, and Overweight on Japan as well as Emerging Markets (including China).