Are Quality stocks in a league of their own?

Stocks of best-in-class companies globally have largely outperformed since March last year. Is today’s unique macroeconomic environment and artificial intelligence boom game-changer?

‘Quality’ stocks are companies with a resilient business model and significant sustainable competitive advantage with high barriers to entry in the long run. They also have superior growth, pricing power, strong brand value, high profit margins, a strong balance sheet, market leadership and often operate in a growing addressable market, that makes them particularly attractive.

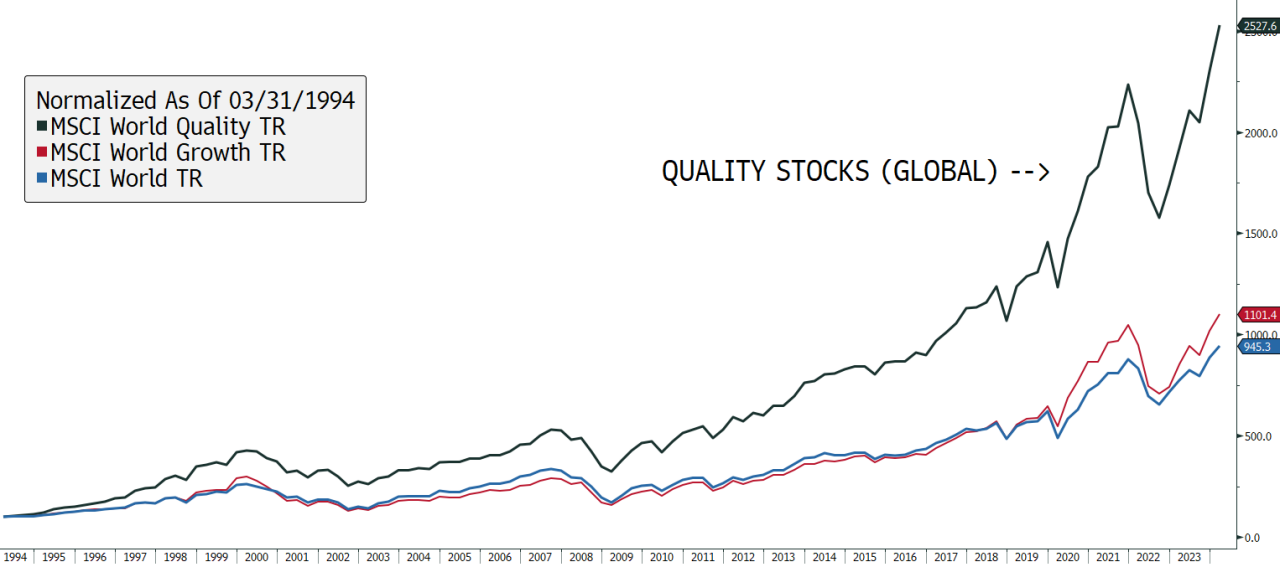

The Quality style has tended to outperform throughout history.

For illustration, the MSCI World Quality Index outperformed the MSCI World Index by 14% in the last year, and by a massive 1500% in the last 30 years.

Quality stocks have outperformed by 1500% in the last 30 years.

Source: BNP Paribas (Suisse) SA, Bloomberg data.

Quality stocks have gained in popularity with investors giving them acronyms such as the “Magnificent 7” (Apple, Microsoft, Amazon, Alphabet, Nvidia, Meta, and Tesla) and the “GRANOLAS” (GSK, Roche, ASML, Nestle, Novartis, Novo Nordisk, L'Oreal, LVMH, Astrazeneca, SAP, and Sanofi). Many of these giants now carry a gigantic market capitalisation of more than 1 trillion Swiss francs and represent a significant weight in world stock indices.

Artificial Intelligence: the next generational tech frontier

Quality companies tend to re-invest massively into their business in R&D or marketing expenses to maintain their barriers to entry through cultivating the technological edge or their brand image.

Artificial intelligence (AI), the next frontier of a potentially generational technological improvement is accelerating growth of many of the quality businesses such as some high-tech semiconductor makers well positioned to sell equipment necessary to enable AI, also referred to as “the shovels for the gold rush”. Others are using AI to gain in productivity or to commercialise their AI-enabled products such as seen in cybersecurity, search, e-commerce, communication services, cloud infrastructure, or for Electric Vehicles.

More traditional businesses with quality attributes such as in luxury have certainly benefited from the resilient demand from the well-to-do consumer and are embracing AI in activities such as marketing campaigns, customisation, and e-commerce. One pain-point in markets has been the economic challenges in China given the country is dealing with its ongoing property crisis and the negative wealth-effect that goes along with it. But longer term, the highly digitalised Chinese economy could be a large beneficiary of AI, and so with it the companies that are successful in operating in the second-most populated country in the world.

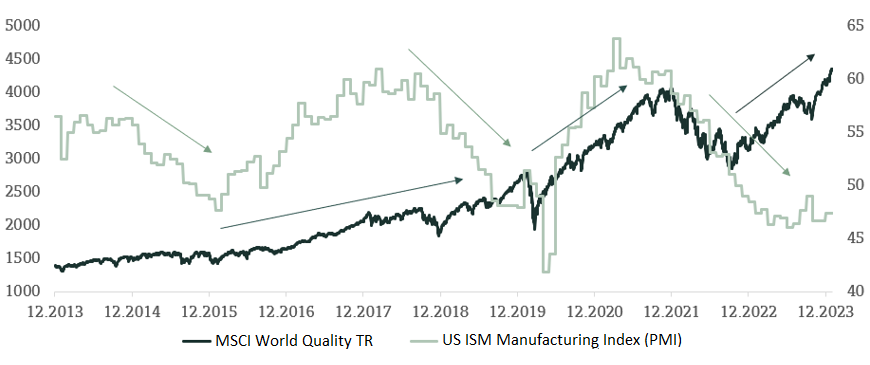

Uncertainty benefits Quality stocks

The end of low interest rates post-2021 with the bear market that followed in 2022 and the war in Ukraine and the higher level of inflation, created a regime change for financial markets. With it came many uncertainties which are worrying investors today. As a result, Quality investing is popular with investors seeking shelter to sail through a period of economic unknows and above-average inflation.

Quality attributes such as strong balance sheets and high profit margins may offer a natural buffer that reassures investors about prospects of longevity.

MSCI World Quality versus US ISM Manufacturing PMI

Source: BNP Paribas (Suisse) SA, Bloomberg data.

As investors seek safety during uncertain times, well-known names or industry-leaders that have survived the test of time may as a result find themselves back at the top of investors wish-lists during volatile times.

Within quality some stocks may at times trade on discounts due one reason or another, such as demand slowdown, poor marketing campaign or challenges with its new product etc. If the reason can be resolved, a re-pricing to the upside may well be in the cards.

In conclusion, Quality stocks as a group are certainly in a unique position to navigate today’s market environment and to face future unknowns. The next crisis or market stress is always looming, with markets correcting 10% or more 1.1 times per year on average, looking at S&P 500 Index data since 1928. So, our message is clear: chose the very best of your horses to be prepared to navigate the ups, and the downs of the economic cycle.

This article is brought to you by the Advisory Solutions Team.

Contributors: Maxime Bonnet - Head of Advisory Solutions, Paul de La Baume - Investment Advisor