Each investor can help to accelerate the transformation of our society by supporting the activities that contribute to it, for example in renewable energies, the circular economy, food security, green mobility, education and financial inclusion. At BNP Paribas Wealth Management, we are convinced that our responsibility is to guide and point our individual clients in this direction, giving them the keys to understand how sustainability is integrated into investment solutions. Thus, they will be able to define their investment goals, and more precisely, choose the options corresponding to their degree of expectation, from a wide range of portfolio management solutions and financial instruments.

At the heart of the economy, the financial sector is a crucial driver for transformation towards an economy which is more respectful of the environment and society. Hence, the BNP Paribas Group is committed to supporting this transition. This involves regularly-updated sector investment and financing policies as well as the formulation of ambitious targets, such as financing a carbon neutral economy by 2050 (limiting global warming to 1.5°C by 2100, compared with the pre-industrial era.

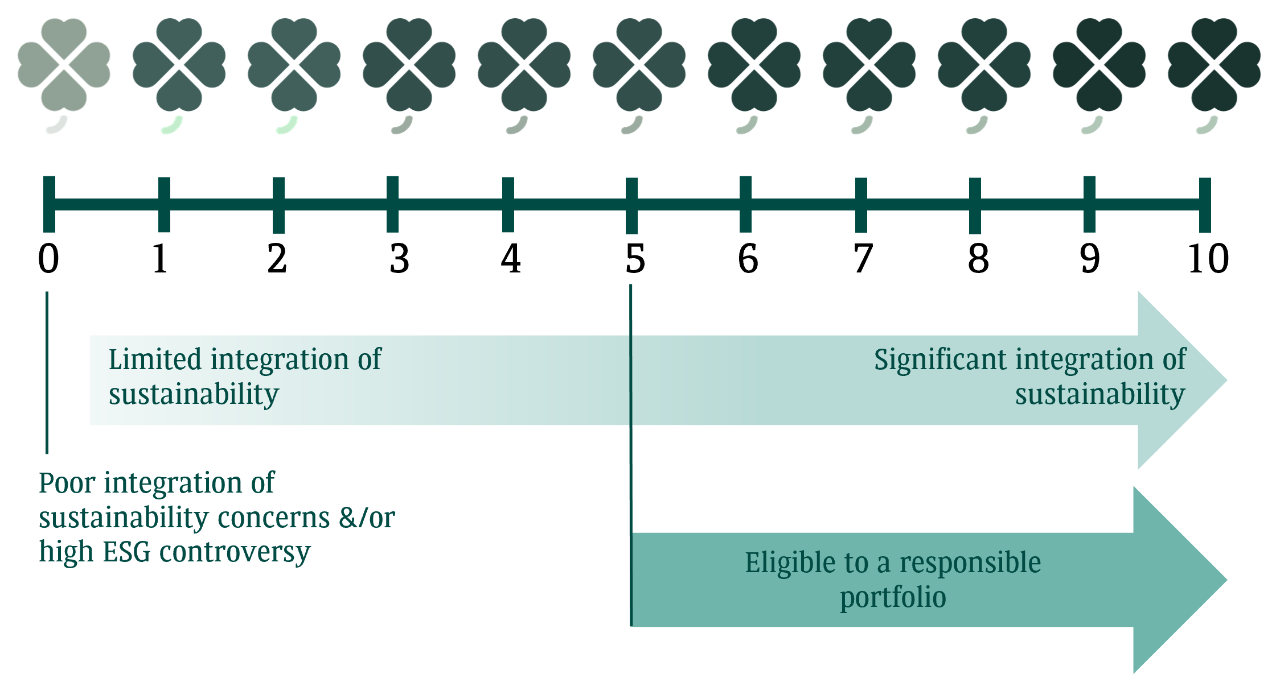

To help them compare the sustainability level of financial instruments in a quick and easy way, we have developed the Clover evaluation. It is an internal analysis grid that allows us to assign to each financial instrument, regardless of the asset class, a rating between zero and ten Clovers (ten being the highest level of sustainability). Our goal is to enable our clients to take this rating into account in their decisions, alongside risks and their desired Return on Investment.

“The Clover assessment is a valuable tool for our customers. By allowing them to quickly compare the level of sustainability of their different investment options, it allows the increasing integration of sustainable development issues into investment decisions. At the same time, the clover assessment helps us to build the management solutions offered to our clients (in advised or discretionary management). It is also an essential tool for engaging with producers of financial instruments and encouraging the increasing integration of ESG criteria into investment strategies and the development of responsible investment solutions.”

Éléonore Bedel, Chief Sustainability Officer

The Clover methodology was built in 2010 before regulations on “responsible” financial instruments were introduced. Indeed, since then regulations have emerged, but there is still no international consensus. Our methodology has been adapted over time with the growing consideration of sustainable development challenges in the economy, the transition of the financial sector towards sustainable finance, and related regulations. It is progressive and is now anchored in a continuously strengthened expertise.”

The first Clover rating report, which will be updated annually, presents BNP Paribas Wealth Management's assessment methodology through two main parts:

- Principles common to all asset classes

- Details of the methodology by asset class

It is a 24-page document that highlights a number of indicators monitored, such as the percentage of the recommended investment universe noted via the Clover methodology, 96.5% at the end of 2022, or the arithmetic average of durability in clovers of our recommended universe: 5.6.

The Clover rating report has also been verified by Deloitte attesting to the robustness and proper application of our Clover methodology. This verification resulted in the production of a document inserted at the end of the Clover rating report.

The Clover rating report is available in English and French.